Bitcoin’s January Selloff: An In-Depth Analysis

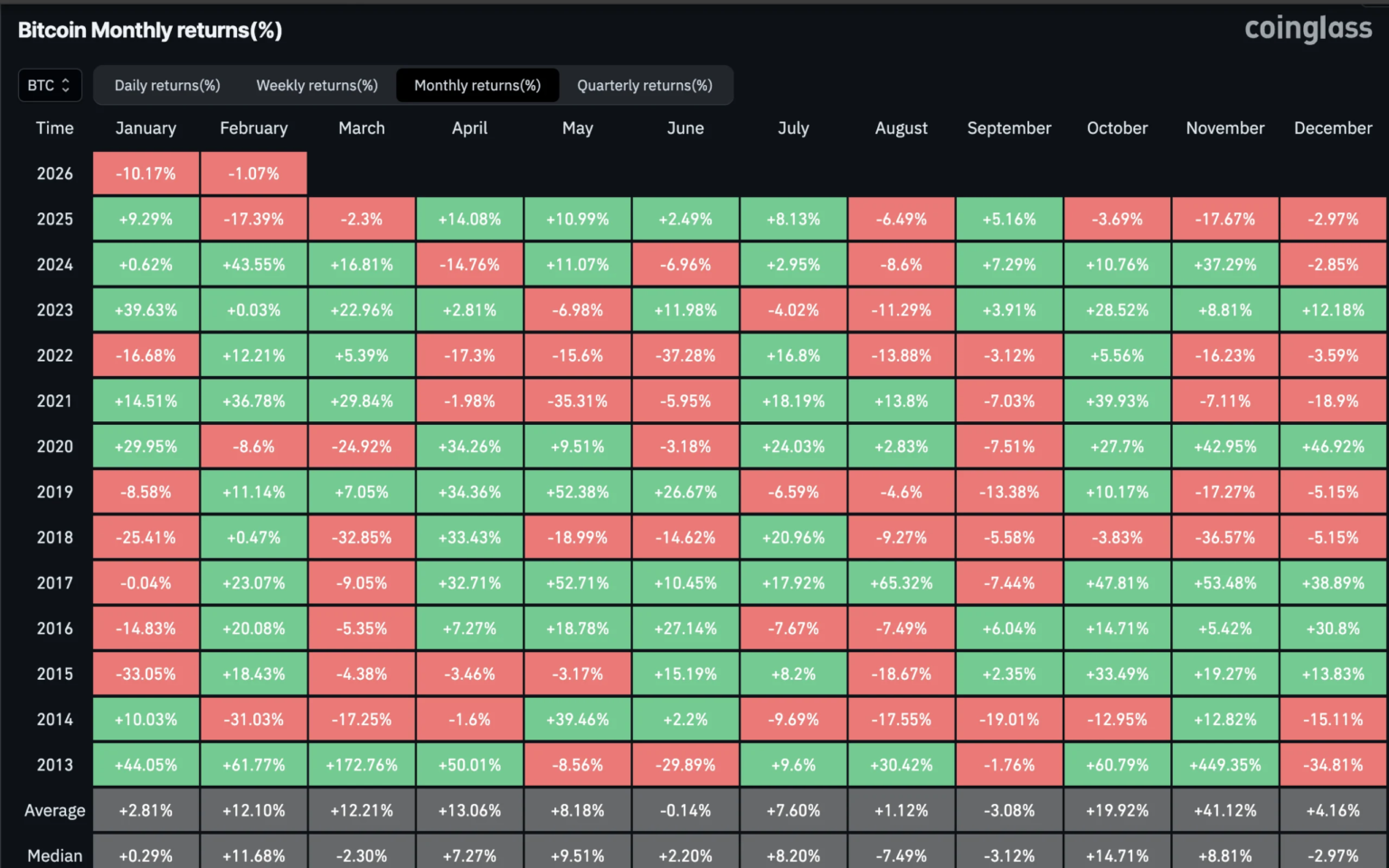

Bitcoin (BTC) has experienced a substantial decline in January, recently dropping to around $77,800 amidst a broader repricing of global liquidity that has affected not just cryptocurrencies but also equities and precious metals. As traditional safe-haven assets have lost their luster, major withdrawals from institutional investors have fueled this downward trend, with global crypto investment products seeing $1.7 billion in outflows recently. This marks one of the worst monthly performances Bitcoin has witnessed since early 2022, closing January with four consecutive negative months—a first since 2018.

Understanding the Market Reset

The latest downturn in Bitcoin is not solely a crypto-specific issue; it forms part of a more extensive global market reset. Analysts posit that dynamic shifts, particularly in U.S. monetary policy expectations, contributed significantly to the current market conditions. Timothy Misir, head of research at BRN, pointed out that key events, such as the nomination of Kevin Warsh to the Federal Reserve chair and unexpected rises in the U.S. Producer Price Index, led to a mass reassessment of financial conditions. The ensuing "risk-off" sentiment sent shockwaves not just through cryptocurrencies but also traditional markets, with gold and silver prices plunging as liquidity concerns grew.

Cross-Asset Market Movements

Market observers noted a similar trend across various assets, with both gold and silver facing substantial price corrections following market turbulence. Institutions like QCP Capital reported that increased margin requirements on leveraged positions led to rapid liquidations and corrections in precious metals. Analysts at JPMorgan echoed this sentiment, noting that Bitcoin futures appeared oversold following recent heavy sell-offs, while silver transitioned from overbought status. The synchrony in liquidation across these diverse asset classes indicates that investors are responding to a common macroeconomic narrative, which further exacerbates the volatility.

The Impact on Derivatives

Bitcoin’s drawdown has had a notable impact on derivatives markets, amplifying the downward pressure on its price. Reports indicate that Bitcoin futures open interest has plummeted, reaching approximately $52 billion—down about 44% from its peak. Speculative participants are stepping back amid the prevailing uncertainty, which has triggered the most significant long liquidation wave since October, accounting for around $5 billion in losses across futures markets.

The combination of declining open interest and rising liquidation pressures suggests that traders are increasingly cautious in this volatile environment, contributing to the overall market retreat. With liquidity tightening, speculative trading is becoming less viable, and this, in turn, adds to the challenging environment for Bitcoin.

Analyzing On-Chain Indicators

On-chain metrics further corroborate the bearish sentiment enveloping Bitcoin. Misir highlighted that many recent buyers are underwater, as Bitcoin currently trades below several short-term cost-basis measures, escalating the risk of capitulation. Additionally, miners are sending coins to exchanges, adding persistent sell pressure at a time of diminishing liquidity. The resultant technical implications have created notable patterns in futures markets, with Bitcoin futures opening the week with a significant downside gap—a rare occurrence that traders closely monitor as a potential price magnet for future rebounds.

Despite the caution in other market indicators, there remains a silver lining. While Bitcoin has dropped approximately 40% from its all-time high of around $126,000, historical comparisons suggest that such drawdowns are not uncommon, with past cycles experiencing much steeper falls. As volatility diminishes, analysts anticipate that Bitcoin may not undergo as drastic a correction this time around.

Looking Ahead: Market Recovery Potential

While the short-term outlook remains turbulent, not all analysts view this as the onset of a prolonged bear market. Some market experts believe the current downturn resembles a temporary bearish phase rather than the long crypto winter characterized by extended declines. Analysts from Bernstein anticipate a cycle reversal could emerge later in 2026, estimating that Bitcoin may stabilize around the $60,000 mark as forced selling diminishes and macroeconomic conditions clarify.

Interestingly, data suggests that large holders are accumulating Bitcoin amid the ongoing selloff. Reports reveal that the number of addresses holding between 1,000 and 10,000 Bitcoin is rising, indicating a divergence from previous downturns. This accumulation by significant investors may suggest a growing confidence in Bitcoin’s long-term prospects, even as immediate conditions remain volatile.

Conclusion

As the Bitcoin market continues to navigate through a challenging environment, characterized by institutional sell-offs and widespread liquidity concerns, the focus remains on macroeconomic trends rather than crypto-specific factors. Analysts suggest that while liquidity and market resets dominate the current landscape, future recovery could be on the horizon, particularly as large investors make strategic acquisitions. Given the fluctuations and the historical context, it remains essential for investors to closely monitor macroeconomic indicators and potential signs of stabilization.