The Current State of the Crypto Market: A Deep Dive into Recent Developments

As the crypto market grapples with a significant capitulation phase, Bitcoin’s recent decline below $90,000 is raising alarm bells among investors and analysts alike. Driven by a combination of economic factors, including hawkish rate repricing, substantial ETF outflows, and waning liquidity conditions, Bitcoin’s drop reflects a more extensive risk-off sentiment pervading global markets. This article looks into the current state of the crypto landscape, examining the implications of Bitcoin’s decline, the role of macroeconomic factors, and what lies ahead for investors.

Bitcoin’s Steep Decline: An Overview

On Tuesday, Bitcoin experienced a troubling drop, sliding below the psychological threshold of $90,000. Although the largest cryptocurrency managed to recover slightly to around $91,200 after hitting an intraday low of approximately $89,300, these levels are concerning—not seen since April. Analysts mention that this recent downturn has contributed to a year-to-date negative return, dimming the optimism that characterized earlier in the year. In parallel, Ethereum also faced pressure, briefly dipping toward $3,000, while other cryptocurrencies like BNB and Solana followed suit, further contributing to a declining total crypto market capitalization that has sunk to $3.09 trillion.

Macro Factors Worsening Market Conditions

The backdrop of declining crypto prices encompasses macroeconomic changes that have amplified risk aversion among traders. Notably, a hawkish shift in U.S. Federal Reserve communications has resulted in diminishing expectations for a rate cut in December. According to insights from market analysts, this shift has tightened financial conditions significantly, compelling a deleveraging of risk assets across markets. Timothy Misir, head of research at BRN, articulated this trend, confirming that the recent macro developments have unambiguously led to less favorable conditions for riskier investments like cryptocurrency.

ETF Outflows: A Compounding Factor

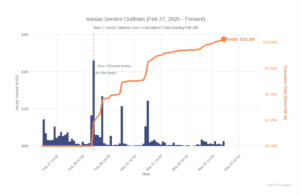

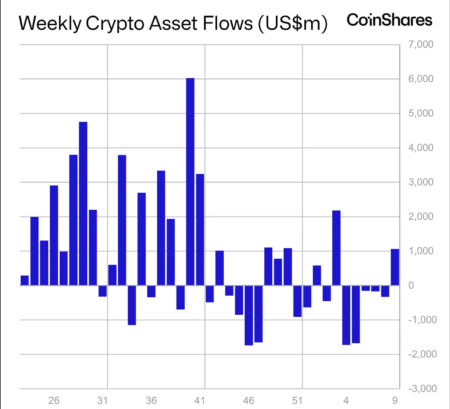

The decline in Bitcoin’s value has been exacerbated by significant outflows from exchange-traded funds (ETFs). Recent reports indicate that Bitcoin and Ethereum spot ETFs suffered a combined $437 million in outflows last week. Analysts identify the breach of the $90,000 mark as a notable psychological moment, noting that the market’s thin liquidity and concentrated leverage made it increasingly susceptible to extreme volatility. Furthermore, data from CoinGlass reveals that in just 24 hours, the crypto market experienced over $1 billion in liquidations, primarily driven by long positions.

Signs of Capitulation Amidst Weakening Prices

Amid these turbulent times, various on-chain indicators suggest that the market is experiencing late-stage capitulation. Short-term holders, primarily newer investors who entered around the $94,000 average cost basis, are actively offloading their assets as prices slide. Misir highlighted that a staggering 31,800 Bitcoins were sent to exchanges at a loss, emphasizing the distress among investors. While these signs indicate considerable selling pressure, long-term buyers continue to accumulate Bitcoins, showcasing a divergence in strategy amid falling prices. El Salvador and Strategy, the firm led by prominent Bitcoin advocate Michael Saylor, recently increased their holdings, which could signal a foundation of support for the future.

The Psychological Impact and Market Sentiment

The psychological dimensions of this downturn cannot be underestimated. The decline below key price levels feeds into a self-perpetuating bearish cycle, with broader financial markets reacting negatively. Analysts, like Kyle Rodda from Capital.com, consider Bitcoin as a "barometer for risk appetite," arguing that its recent performance could have profound implications for traditional markets. As investors recalibrate their positions, the overall sentiment is shifting toward caution, leading to a heightened sense of fear and uncertainty—elements that often characterize market capitulation.

Conclusion: Navigating a Convoluted Market Landscape

As we stand at a critical junction in the crypto market, a mix of external and internal factors is driving uncertainty and volatility. The convergence of macroeconomic developments, alongside ETF outflows and deteriorating liquidity conditions, frames a complex landscape for prospective investors. While signs of capitulation are evident, serious buyers are still entering the market, suggesting that while fear may dominate the short term, there could be potential for recovery. For traders and investors alike, it remains crucial to remain informed and vigilant as they navigate this labyrinth of risk and opportunity.

In summary, being aware of both the risks and opportunities present in the crypto landscape is fundamental during such tumultuous times. Adopting a long-term perspective could prove beneficial, allowing savvy investors to position themselves effectively as the market seeks a potential turning point. The crypto market remains unpredictable, and vigilance will be key in tackling the challenges that lie ahead.