Bitcoin Rebounds Amid U.S.-China Diplomacy and Fed Decisions

Bitcoin (BTC) has made a notable rebound to $110,000 following a volatile session of the Federal Open Market Committee (FOMC). The improved sentiment in global markets, attributed to the easing of tensions between Washington and Beijing, has played a pivotal role, even though U.S. spot crypto exchange-traded funds (ETFs) experienced significant outflows recently. According to data from The Block, Bitcoin fluctuated between $109,600 and $110,200 early Friday, recovering from a drop that saw it near $107,000. This recovery comes on the heels of Federal Reserve Chair Jerome Powell’s remarks regarding potential interest rate cuts, emphasizing that a December rate cut “is not a foregone conclusion.”

Market analysts, like Kyle Rodda from Capital.com, note that traders are pivoting their focus from the Fed’s "hawkish approach" to the ongoing U.S.–China trade negotiations. In early reports, Ether (ETH) was trading around $3,900, while Binance Coin (BNB) hovered near $1,100, and Solana (SOL) was below $190. The total value of the cryptocurrency market remains close to $3.76 trillion, indicating a robust market despite recent challenges.

Diplomacy Dims Macro Concerns

In what analysts describe as a shift in focus, diplomacy has taken precedence during a macroeconomic data blackout in the U.S. Following a meeting between President Donald Trump and Chinese President Xi Jinping, both leaders announced tariff reductions and made commitments addressing several critical issues. According to Timothy Misir, head of research at BRN, this diplomatic engagement has provided a “confidence boost” across several domains, including trade, energy, and health enforcement targeting fentanyl. However, the temporary suspension of the U.S. GDP report until December due to a government shutdown has complicated the macroeconomic landscape, leaving investors in the dark regarding key economic indicators.

Market experts express concern that ongoing governmental gridlock further obscures macroeconomic visibility, creating uncertainties for traders and investors. This cautious atmosphere has directly impacted U.S. spot ETF flows, as highlighted by recent data showing significant outflows. On a particularly tough Thursday, U.S. spot Bitcoin ETFs faced around $488 million in net outflows, with no individual fund managing to record net inflows. Similarly, spot Ether ETFs reported approximately $184 million in outflows. Interestingly, spot Solana ETFs defied this trend, garnering around $37.33 million in inflows, marking their third consecutive day of positive movement, driven primarily by Bitwise’s BSOL.

October Performance and Market Sentiment

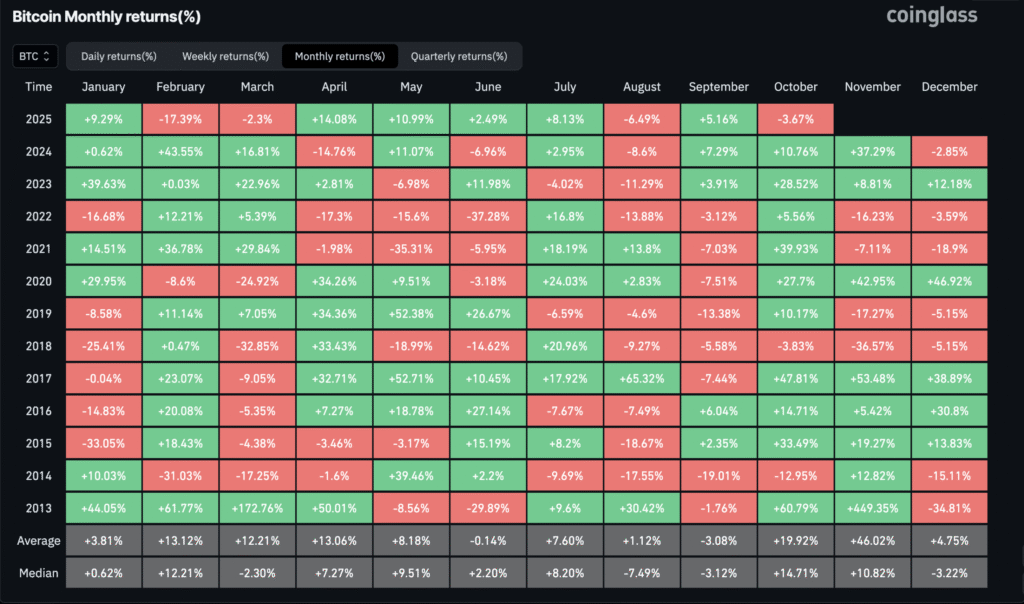

As October progresses, it has emerged as one of Bitcoin’s weakest months in over a decade, with early highs fizzling out into over $10 billion in liquidations, according to CoinGlass data. Typically viewed as a bullish period for Bitcoin, this October’s downturn has surprised many analysts, prompting a reevaluation of the market’s direction. Despite the ongoing challenges, Paul Howard, senior director at Wincent, maintains a positive long-term outlook for Bitcoin. He predicts that BTC prices will stabilize within the $110,000-$120,000 range following the anticipated Fed rate cut, yet acknowledges that concerns surrounding the potential for further rate context have slightly lowered cryptocurrency prices.

Howard’s sentiments reflect a broader market optimism where he notes that the current environment may create opportunities for short-term accumulation ahead of potential macroeconomic improvements as the calendar shifts into November. This sentiment aligns with the expectation that risk assets, including Bitcoin, may experience upward momentum leading into the end of the year, with some consolidation likely before year’s end.

Market Trends and Technical Analysis

As investors remain engaged in the evolving cryptocurrency landscape, many are turning to technical analysis to guide their trading decisions. Patterns of volatility, particularly seen in recent trading sessions, indicate that market players are adjusting strategies based on macroeconomic cues and geopolitical developments. The interplay between rising geopolitical tensions and shifting monetary policies is fostering a climate where traders are keenly focused on news feeds and indicators that could signal potential shifts in capital flow.

In a market ecosystem that remains sensitive to high-profile events, analysts suggest that understanding Bitcoin’s performance against such backdrops is critical for investors. Monitoring upcoming announcements from the Fed and developments from the U.S.-China trade dialogue can provide valuable insight into future price trends. As capital continues to flow into and out of various instruments, the emphasis on strategic positioning has never been more necessary.

Geopolitical Factors and Their Impact

The broader geopolitical landscape cannot be ignored in assessing Bitcoin and the cryptocurrency market’s trajectory. Broader trade agreements, international relations, and domestic policies heavily influence market sentiment, especially in a currency that is fundamentally tied to investor confidence. As the U.S. and China navigate tariff reductions and economic commitments, the implications of such agreements can ripple across global markets—impacting not only cryptocurrencies but also traditional assets.

The current geopolitical climate highlights the fragility and interconnectedness of markets in today’s digital economy. Investors who remain attuned to these shifting dynamics may find themselves better positioned as they navigate through volatility and uncertainty. Understanding the intricate relationship between political developments and market responses is crucial for those looking to capitalize on investment opportunities.

The Future of Bitcoin Trading

As Bitcoin stabilizes around the $110,000 mark, seasoned traders and new investors alike are left pondering the future of cryptocurrency investments. The prospect of a Federal Reserve rate cut and a recovering sentiment in the U.S.-China dialogue offers promise, yet caution is also warranted. With Bitcoin’s historical performance characterized by high volatility, traders should remain vigilant in their strategies.

Market projections, like those of Paul Howard, highlight an optimistic outlook suggesting potential rises in Bitcoin’s value driven by macro conditions and investor behavior. However, the potential for short-term fluctuations should prompt investors to manage risk effectively while considering long-term prospects. As the cryptocurrency market continues to evolve, staying informed about macroeconomic indicators, geopolitical events, and overall market sentiment will be critical for navigating future investments.

In summary, the current landscape of Bitcoin trading reflects an interplay of multiple contributing factors, signaling an intriguing yet complex environment for investors. As more traders look to engage with crypto assets, understanding these dynamics can lead to informed decisions that capitalize on the unique opportunities presented by this digital frontier.