Title: MicroStrategy’s Bitcoin Holdings: A Deep Dive Into Bernstein’s Optimistic Projections

In the ever-evolving landscape of cryptocurrency investment, MicroStrategy, now called Strategy, has emerged as a strong player in the Bitcoin (BTC) market. According to Bernstein’s latest research, Strategy could see its Bitcoin holdings soar to over 1 million BTC, representing around 5% of Bitcoin’s total supply of 21 million coins. This bullish forecast comes on the heels of their recent financial results and a series of strategic BTC acquisitions. Analysts have rated the firm as outperforming, assigning a price target of $600, indicating a potential upside of 75% based on current valuations.

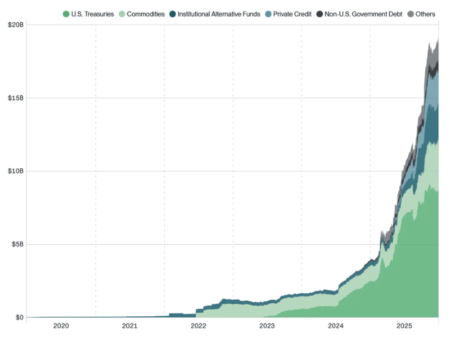

Bernstein’s analysis employs a sum-of-the-parts approach, combining the value of Strategy’s software business with its Bitcoin holdings. By applying a 2x enterprise value-to-sales (EV/sales) multiple on the software segment and incorporating a 55% long-term premium on its Bitcoin treasury, the analysts project significant earnings growth for the firm. They anticipate earnings per share reaching $207, a dramatic increase from prior estimates of $67.50, driven primarily by enhanced fair value gains stemming from a significantly larger Bitcoin treasury.

The analysts predict Bitcoin prices to experience significant growth in the coming years, foreseeing a potential peak of around $200,000 by the end of 2025, $500,000 by 2029, and an astounding $1 million by 2033. However, this optimistic outlook is tempered with caution, as Bernstein’s model includes various scenarios, including base and bear cases, which suggest different outcomes for Strategy’s future Bitcoin holdings. In the base case, their Bitcoin stack could reach 4% of circulating supply by 2033, while a bear market could stagnate holdings at 2.6%.

Recently, Strategy announced it has surpassed 500,000 BTC in total holdings, following the acquisition of an additional 6,911 BTC for approximately $584.1 million. This represents another step in their aggressive acquisition strategy, funded through the successful sale of securities including class A common stock and perpetual convertible preference shares. Currently, Strategy holds 506,137 BTC, valued at over $44 billion, and has raised approximately $23 billion in capital since October alone. The average purchase price for this significant amount of Bitcoin stands at around $66,608 per coin.

Bernstein’s report underscores how effectively Strategy has capitalized on favorable market conditions to expand its Bitcoin portfolio. The firm has accounted for 5% of global equity capital raised in 2024, 1% of global convertible debt, and a striking 15% of current global preference issues. Strategy’s recent preference shares strategy is noteworthy, having already raised $1.5 billion in 2024. These preferred shares carry varying characteristics, including convertible options and attractive dividends, reflecting a focused attempt to secure long-term capital for Bitcoin acquisitions while minimizing dilution and costs.

Despite the significant market premium over its Bitcoin net asset value (NAV), reservations among investors about Strategy’s valuation remain. Nevertheless, the firm is increasingly positioning its Bitcoin treasury as the backbone of its overall business strategy. With substantial liquidity from their existing Bitcoin holdings, Strategy manages risks similar to traditional financial operations. While volatility in Bitcoin values persists, the firm’s outlook amidst its current liquidity risks and dividend payments remains stable, with cash management strategies in place to facilitate ongoing acquisitions and support operations.

As of now, Strategy’s Class A common stock (MSTR) has displayed strong performance, gaining over 112% in the past year. Despite minor fluctuations in recent trading sessions, its overall trajectory reinforces Market Analyst sentiments that the stock has substantial growth potential as the company continues its ambitious Bitcoin acquisition strategy. As we navigate through the complexities of the cryptocurrency market, all eyes will remain on MicroStrategy as it continues to sculpt its future in Bitcoin investments against a backdrop of uncertain global market dynamics.

In conclusion, MicroStrategy’s strategic positioning in the Bitcoin market, supported by optimistic projections from Bernstein, bolsters the notion that the firm could play a pivotal role in shaping the landscape of cryptocurrency investments. While the market faces inherent risks, Strategy’s deep understanding of capital management, risk control, and long-term vision positions it as a vanguard in digital assets. Whether through aggressive acquisitions or market maneuvers, the next steps of this corporate behemoth in the cryptocurrency sphere will be critical to watch as they unfold in the coming years.