The Impact of the November 21 Flash Crash on the Cryptocurrency Market

The cryptocurrency market faced a devastating flash crash on November 21, characterized by an abrupt sell-off that saw Bitcoin plummet from over $85,000 to approximately $82,032 within minutes. This sudden decline not only shook investor confidence but also resulted in the overall cryptocurrency market capitalization dipping below the critical $3 trillion mark. In this article, we will explore the causes of this flash crash, its effects on Bitcoin, and the broader implications for altcoins and the cryptocurrency ecosystem as a whole.

Understanding the Flash Crash

Flash crashes typically occur due to a combination of market volatility and external influences. In this instance, various factors, including macroeconomic pressures and regulatory concerns, contributed to the sharp decline. Such incidents serve as a potent reminder of the inherent risks associated with trading cryptocurrencies, where prices can swing dramatically in a matter of moments. Understanding why this crash happened requires a look into both market sentiment and the larger financial landscape.

Bitcoin’s Price Plummet

During the flash crash, Bitcoin witnessed a staggering drop in value, showcasing the volatility that characterizes the cryptocurrency market. After soaring above the $85,000 mark, the rapid descent to $82,032 left many investors reeling. The fact that Bitcoin could lose thousands of dollars in value within minutes underscores the importance of risk management for traders and investors alike. This incident has sparked debates about the sustainability of such high price levels and has raised concerns about potential future corrections.

The Effects on Altcoins

While Bitcoin’s volatility is often the headline story, altcoins were also severely affected during this market turmoil. Many altcoins saw their values decimated during the crash, with some experiencing even larger percentage losses compared to Bitcoin. The interconnectedness of the cryptocurrency market means that a major event can often trigger widespread panic selling, leading to cascading losses across various assets. This flash crash has highlighted the vulnerability of altcoins in times of market distress, prompting investors to rethink their positions and strategies.

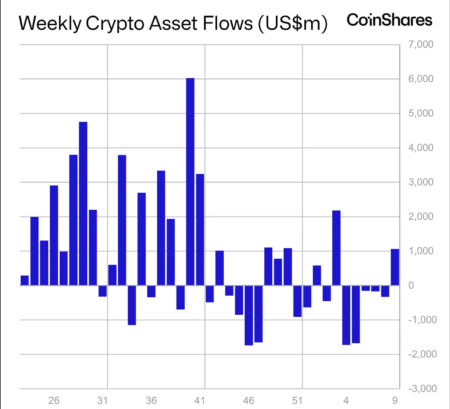

Market Capitalization Collapse

The total market capitalization of cryptocurrencies dropping below $3 trillion is significant. This threshold had been a point of psychological importance for investors, symbolizing the continued growth and acceptance of cryptocurrencies in the mainstream financial landscape. A drop below this level can indicate weakening investor confidence and may set the stage for further declines. Market capitalization plays a crucial role in influencing investment decisions, and a decrease like this can lead to a more cautious approach from both retail and institutional investors.

Long-Term Implications for Cryptocurrency

The repercussions of the November 21 flash crash may have long-term implications for the cryptocurrency market. It serves as a reminder that while cryptocurrencies offer unprecedented opportunities for growth, they also pose significant risks that must be managed effectively. Regulatory scrutiny and the need for better market infrastructure are becoming increasingly important discussions among stakeholders. As the market matures, the lessons learned from such crashes may contribute to the development of measures aimed at stabilizing prices and restoring investor confidence.

Conclusion

The flash crash of November 21 has underscored the volatile nature of the cryptocurrency market, impacting Bitcoin and altcoins alike. As the market navigates this turbulent period, investors must approach with caution, understanding both the risks and rewards inherent in this dynamic landscape. The potential for future crashes remains, making risk management and informed decision-making critical for anyone looking to invest in cryptocurrencies. As the industry continues to evolve, the focus will likely shift toward building a more resilient market that can withstand fluctuations and foster long-term growth.