U.S. December Jobs Report: Mixed Signals and Market Reactions

The U.S. December jobs report has revealed a complex picture of the labor market, with crucial indicators showing signs of both weakness and resilience. While the nonfarm payrolls fell short of expectations, the unemployment rate improved slightly, highlighting the contrasting dynamics at play. Understanding these trends is essential for investors and market watchers as they navigate the implications for monetary policy and asset performance, particularly in cryptocurrencies like Bitcoin.

Nonfarm Payrolls Lack Expectations

Data released by the U.S. Bureau of Labor Statistics indicates that total nonfarm payrolls rose by just 50,000 in December, considerably less than the anticipated 60,000. This figure also reflects a downward revision of previous months, with October’s growth being revised from a negative figure of -105,000 to -173,000. Furthermore, the average payroll gains in 2025 have been reported at 49,000 per month, lagging significantly behind the 168,000 reported in 2024. This decline raises questions about the strength of the job market and suggests a potential cooling effect on job creation, which could have far-reaching consequences across the economy, including the cryptocurrency market.

Unemployment Rate Shows Improvement

In contrast to the disappointing nonfarm payrolls, the unemployment rate experienced a drop to 4.4%, outperforming expectations of 4.5%. This decline also comes after a revision of the November unemployment rate, which was previously reported at 4.5%. The reduction in the unemployment rate paints a somewhat optimistic picture, signaling a potential rebound in the labor market. Such indicators are crucial, as Federal Reserve Chair Jerome Powell has emphasized the importance of the unemployment rate in assessing the labor market’s health. This shift may bolster the argument for maintaining current interest rates as the economy adjusts.

Mixed Signals Pose Challenges for Investors

The juxtaposition of the nonfarm payroll data and the decrease in the unemployment rate presents a challenging landscape for investors. While weak job growth creates an environment that may prompt the Federal Reserve to reconsider its monetary policy, a falling unemployment rate introduces uncertainty. Investors need to decipher these mixed signals to make informed decisions regarding various asset classes, including equities and cryptocurrencies. Observing how these dynamics continue to interact will be critical for anticipating future market movements.

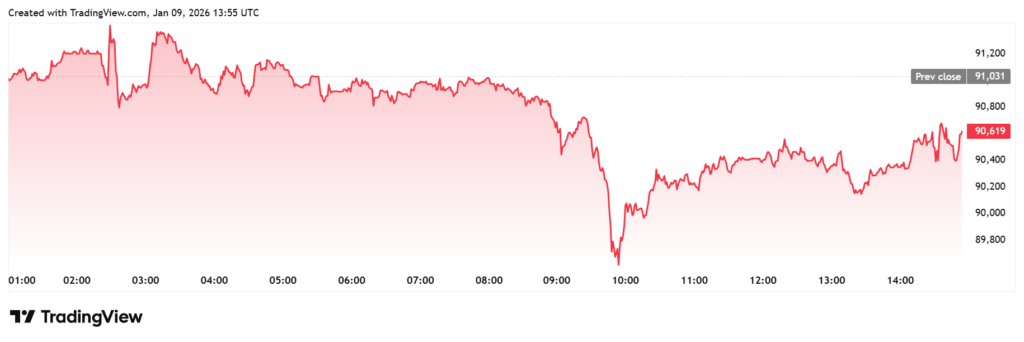

Bitcoin’s Response to Labor Market Data

Following the release of the jobs report, Bitcoin exhibited a notable reaction, quickly climbing to an intraday high of $90,700. Although this represents a rally on the back of the mixed labor market data, it is important to note that Bitcoin remains down on the day after reaching such levels and subsequently falling back from over $91,000. This volatility underscores the sensitivity of cryptocurrencies to macroeconomic indicators, particularly those pertaining to employment and monetary policy.

The Fed’s Interest Rate Decisions

The labor market dynamics revealed by the December jobs report are particularly pertinent to the Federal Reserve’s upcoming decisions on interest rates. With traders increasingly betting that the Fed will keep rates unchanged at the next Federal Open Market Committee (FOMC) meeting in January, the ongoing assessment of employment indicators becomes paramount. The positive movement in the unemployment rate could support the Fed’s cautious approach, balancing the need for economic stability with the potential for inflationary pressures.

Conclusion: Navigating a Complex Landscape

In conclusion, the U.S. December jobs report illustrates a complex interplay of positive and negative signs within the labor market. While nonfarm payroll growth has disappointed, the falling unemployment rate offers a glimmer of hope. Investors, particularly in the cryptocurrency space, must remain vigilant as they assess the implications of these indicators for monetary policy and market dynamics. As the Fed prepares to evaluate its next steps, understanding how these trends influence interest rates can provide valuable insights for navigating the evolving financial landscape.