Cryptocurrency Market Alert: Bitcoin and Ethereum Prices See Significant Decline

The cryptocurrency market remains on high alert as Bitcoin (BTC) and Ethereum (ETH) experience a notable price drop exceeding 7% today. This downturn has crypto traders bracing for heightened volatility, especially with the impending expiry of a substantial amount of Bitcoin and Ethereum options. As traders navigate these turbulent waters, the upcoming expiry is generating a sense of uncertainty and caution.

Heavy Options Expiry Fuels Market Jitters

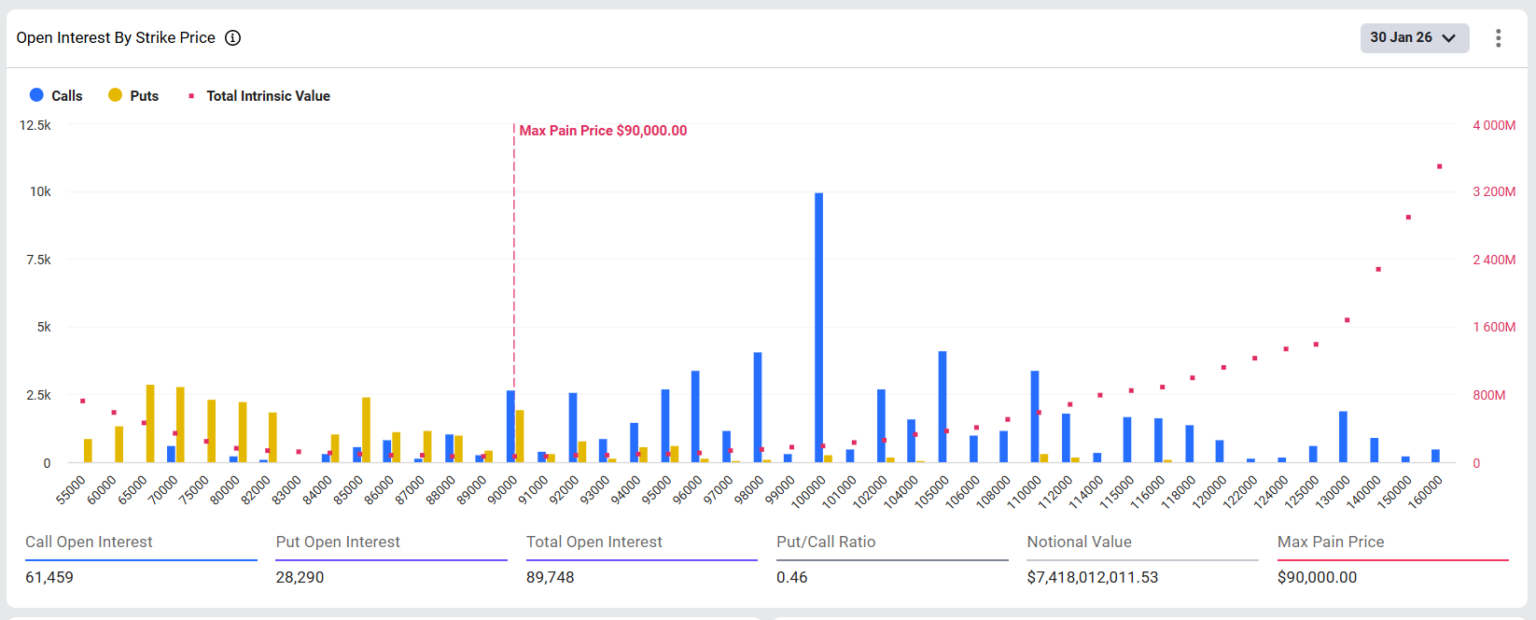

Recent data from the prominent crypto derivatives exchange Deribit reveals that over 89,000 Bitcoin options, valued at approximately $7.4 billion, are set to expire. This scenario has sparked anxiety among traders, evidenced by a significant drop in the put-call ratio, now sitting at 0.46. Such levels typically indicate bullish sentiment, yet the unfolding market conditions suggest otherwise. Over the past 24 hours, put volume has noticeably exceeded call volume, pushing the put-call ratio to a bearish 1.12, signaling an increasing sense of apprehension following the recent market crash.

Implied volatility for Bitcoin has surged, hovering around 45% for main-term options. Market analysts point towards a max pain price of $90,000, highlighting that the probabilities of BTC expiring above the $82,000 strike price are considerably higher. As the market reacts, traders are predicting that Bitcoin may consolidate between $82,000 and $85,000, awaiting guidance from broader economic indicators, ETF developments, and overall market sentiment.

Ethereum Faces Similar Market Pressure

On the Ethereum front, over 432,000 options, valued at nearly $1.18 billion, are also facing expiry today. Interestingly, despite a bullish put-call ratio of 0.70, market sentiment has dampened as traders have started liquidating their positions due to abrupt price fluctuations. Currently, Ethereum is tracing a max pain point of $3,000, significantly above its current trading price of approximately $2,736. Experts suggest that the $2,500 mark could serve as robust support for ETH in the short term.

As with Bitcoin, the put volume for Ethereum has substantially surpassed call volume over the last day, resulting in a put-call ratio of 1.48. This trend signifies a bearish outlook among options traders, indicating that cautious sentiment is prevalent as the expiration date draws near.

Anticipation of Increased Market Volatility

The expiry of Bitcoin and Ethereum options, alongside traditional financial derivatives, introduces a risk of increased price volatility, as traders aim to close or roll over positions. This will compel both crypto and equity markets to absorb the latest shocks. Traders are particularly keen to assess how both markets will react to economic data releases, specifically the upcoming December US Producer Price Index (PPI) inflation figures, with expectations set at 0.2%.

In conjunction with the PPI data release, President Trump’s anticipated nomination of Kevin Warsh as Federal Reserve Chair adds another layer of uncertainty. The current probability of Warsh’s nomination stands at 94%, according to Polymarket. Experts at 10x Research express concern that Warsh’s hawkish stances could escalate selling pressure on Bitcoin and the broader cryptocurrency market.

Shifts in Investor Sentiment and Whales’ Activity

The sentiment among Bitcoin long-term holders appears to be turning bearish, compounded by notable liquidation activities from cryptocurrency whales. Additionally, since December, stablecoins are experiencing a significant exodus, reflecting trader apprehensions regarding forthcoming market developments and policy changes in response to Warsh’s potential candidacy. This situation encapsulates a complex interplay between market fundamentals and geopolitical events, highlighting the nuances that influence market sentiments.

Analyzing the current performance, Bitcoin is trading at around $82,576, reflecting a steep 7% decline over the past 24 hours. The daily trading range saw lows of $81,071 and highs of $88,330. Meanwhile, Ethereum is currently valued at $2,735, having seen limited positive movement amid the overall downturn.

The Road Ahead: Monitoring Market Signals

As the cryptocurrency landscape evolves, traders are keenly observing various indicators, from macroeconomic data releases to regulatory developments affecting the sector. The forthcoming PPI data will be pivotal in defining the market trajectory, as traders seek clarity on inflation trends that could influence monetary policy. Moreover, the potential ramifications of Kevin Warsh’s nomination as Fed Chair pose significant implications for the cryptocurrency sector, further complicating the market’s outlook.

In a landscape where both Bitcoin and Ethereum are significantly intertwined with traditional financial markets, the next few days are likely to be critical. The interplay of options expiry, economic data, and investor behavior will collectively shape the path forward for cryptocurrencies.

Conclusion: Navigating Uncertainty in the Crypto Market

As Bitcoin and Ethereum face regulatory scrutiny and market volatility, traders must remain vigilant amidst the fluctuating landscape. The sizeable options expiry taking place today serves as a reminder of the inherent risks within crypto markets, compounded by external economic factors and sentiment shifts. Navigating these complexities will require a keen understanding of market signals, and a strategic approach to investment.

In this period of uncertainty, informed traders will be better positioned to anticipate price movements and adjust their strategies accordingly. The rise in demand for protective puts reflects a cautious yet strategic approach among investors as they look toward both short-term fluctuations and long-term potential in an evolving crypto market.