Ethereum Faces Selling Pressure: What Investors Need to Know

Ethereum, often recognized for its innovative blockchain technology, is currently facing renewed selling pressure. As cryptocurrency markets experience a downturn, investors must decide whether to buy the dip or continue liquidating their holdings. This situation has been exacerbated by high-profile selling activities, notably from Ethereum co-founder Vitalik Buterin and significant movements from Trend Research. Let’s explore the implications of these developments on the market.

Vitalik Buterin’s Notable ETH Sales

Vitalik Buterin has been actively selling portions of his ETH holdings recently, which has contributed to bearish sentiment in the market. Reports indicate that on February 3, he sold 493 ETH, valued at approximately $1.16 million. This was not a standalone incident; he had already sold 211.84 ETH for 500,000 USDC prior to this. In addition, Buterin converted over 5,000 ETH to Wrapped Ethereum (WETH), presumably preparing for more strategic sales. While his motivations include funding open-source projects, the timing of these sales during a market downturn raised concerns among investors, contributing to panic and a lack of confidence.

Trend Research’s Liquidation Activities

Compounding the market pressures from Buterin is the selling activity by Trend Research. This firm deposited 30,000 ETH on Binance, and over recent days, it has liquidated a total of 93,588 ETH, primarily to manage loan repayments amid leveraged positions. The firm’s portfolio value has plummeted from nearly $2 billion to approximately $1.33 billion, with a liquidation price range between $1,781 and $1,862. This scale of selling has further fueled market anxiety, as such moves can trigger cascading effects, leading to more selling from other investors.

Ethereum’s Recent Price Movements

As the selling pressure intensified, Ethereum’s price reflected the broader sentiment. After a notable rebound of over 6%, ETH’s price retraced to around $2,320. This decline follows a sharp drop of more than 30%, sending the asset below $2,200 at certain points. For the past 24 hours, ETH’s trading volume has decreased by 15%, indicating waning trader interest. Analysts suggest that Ethereum needs to reclaim a price above the 200-week moving average of $2,451 for a convincing reversal of its current downtrend.

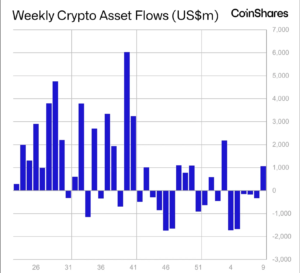

Institutional Interest Amid Market Turbulence

Despite the bearish sentiment, some institutional investors are seizing opportunities to accumulate ETH during this market downturn. For instance, DBS Bank reportedly acquired 24,898 ETH over the past week, indicating that some market participants view this dip as a viable entry point. Such institutional buying often provides a stabilizing effect on prices and can signal that the asset is being undervalued.

Analysts Weigh In on Market Sentiment

Market analysts have mixed views following these recent developments. A significant drop in the ETH/BTC trading pair, failing to hold at the 0.032 level, has raised bearish flags. Notably, one influential whale experienced a staggering loss of $110 million in a single day, which has amplified fears of further declines. Experts now point to the 0.026 and 0.03 levels as critical areas to watch as sentiments evolve.

The Derivatives Market and Future Outlook

Lastly, activity in the derivatives market indicates ongoing selling pressure. Recent data from CoinGlass shows a nearly 1% decline in total open interest for ETH futures, now standing at approximately $28.16 billion. Furthermore, XRP futures open interest also saw similar decreases, suggesting that traders are hedging against further declines. The current dynamics imply a cautious market outlook, making it essential for investors to stay vigilant as they navigate the evolving landscape.

In conclusion, Ethereum faces significant challenges as it grapples with selling pressure stemming from prominent figures like Vitalik Buterin and Trend Research. While some institutional investors view the dip as a buying opportunity, the overall market sentiment remains cautious. Investors need to keep a close watch on price movements, institutional activities, and derivatives to navigate this volatile environment effectively.